Finzsoft replaces its legacy document generation system with Docmosis Cloud.

About Finzsoft

Finzsoft is a well-established fintech based in Auckland, New Zealand.

Since 1986, Finzsoft has been a leading innovator in banking technology, helping financial institutions across Australia and New Zealand manage and modernise their operations.

At the heart of their offering is Sovereign, a comprehensive banking platform designed to be configurable and client-centric, covering automated customer onboarding and loan origination, electronic banking, full life cycle management of loans and customers, leasing and funds management.

Sovereign’s modular design empowers banks and credit unions to adapt swiftly to evolving markets and regulations. As CEO Helen Hatchard notes, “In today’s rapidly evolving banking landscape, only technology that is truly open and adaptable can empower financial institutions to stay ahead. At Finzsoft, we are committed to delivering solutions that enable our clients to thrive amid constant change.”

Finzsoft’s strategic focus remains on core banking expertise, enhanced by partnerships with specialists in complementary areas. Sovereign’s API-driven open architecture integrates with best‑of‑breed solutions for specialised functions such as ID verification, credit checking and card payment services.

The Challenge

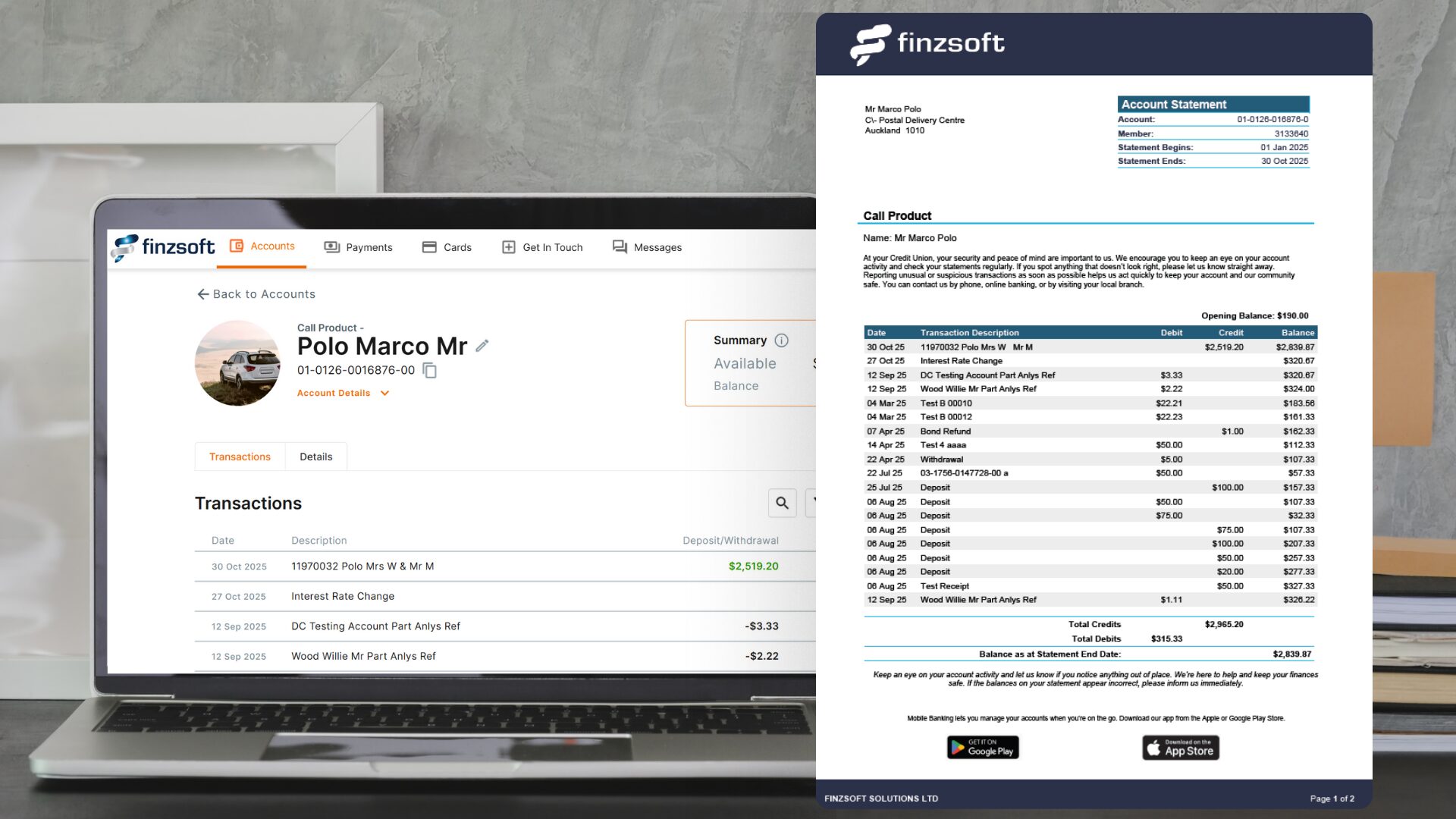

Finzsoft had long relied on its homegrown publishing system to generate documents from the Sovereign platform. The system leveraged Microsoft Word’s Mail Merge, allowing clients to create and maintain their own templates for statements, letters and notices.

As CTO Tim Hurring says, “Document generation is critical for our clients. Whilst they’re no longer posting letters or mailing statements, they’re still generating the same volume, now emailed or delivered through the banking portal. Over time, opportunities to modernise our document generation approach became clear”. As Tim notes, “Our previous system was built on technologies that predated our current Java-based technology stack. While the existing solution served clients well for many years, evolving requirements and complex advanced features could be challenging for some clients.” Finzsoft recognised the importance of making template management even more intuitive and accessible for clients.

Performance optimisation became a key focus, particularly for high-volume batch processing. While the existing system managed substantial workloads, Finzsoft identified opportunities to accelerate statement generation and enhance operational efficiency for clients.

It became clear that rebuilding the system internally would distract from Finzsoft’s core banking roadmap and ultimately, the team determined that partnering with a specialist in document generation would allow Finzsoft to focus on its core banking roadmap. “We realised there are experts in document generation.” says Tim. “As part of our best-of-breed philosophy, we decided to choose the optimal solution and integrate it.”

Evaluation & Decision

Tim summarises it well: “We saw a need to replace our publishing system with a more reliable, cloud native alternative.”

They set clear criteria for the new solution:

- A modern, API-based cloud product

- High performance, suitable for large statement runs

- Word-based templates, for client familiarity

- An intuitive user experience for template creators

Several tools, including Aspose, Formstack and Templafy were on the list to try, but Docmosis Cloud stood out early in the evaluation. “Their Cloud API made complete sense to us,” says Tim.

To check performance, Tim generated a 33-page bank statement using the Docmosis Console: “I pushed it to the extreme to see if there’d be any problems. It took 4.17 seconds.” The same document took 99.6 seconds on their own publishing system. “It was night and day, Docmosis blew our system out of the water.”

Docmosis’s templating approach was another strong fit. Its syntax was similar to Finzsoft’s publishing system but more intuitive for elements like tables and conditional logic. This gave Finzsoft confidence that their clients would be able to manage the template conversion process.

With Docmosis ticking every box, Finzsoft moved forward confidently.

Implementation

Finzsoft began integrating Docmosis into its platform in early 2024. The team first updated their backend programs to produce clean JSON data for the Docmosis API. “We already had XML,” says Tim, “but we tidied up the data. Currency values, for example, are now proper numeric fields.” Once this work was completed, the integration behaved as expected. “There were no real surprises in the test run.” Tim notes.

With the core integration in place, the focus shifted to clients. Many had hundreds of Word templates built over decades. “Some have five, ten, even twenty years of templates.” Tim says. “All templates need to be reconfigured for Docmosis, and Finzsoft is supporting clients to ensure a smooth transition alongside their ongoing workloads.”

Finzsoft decided to adopt a phased rollout, allowing clients to run both systems in parallel and migrate templates at their own pace. “High-volume statements were addressed first, as they had the most performance challenges”, says Tim.

For some clients, staff turnover left no one familiar with the old template syntax, adding to the challenge of the conversion process. In these cases, Finzsoft’s Account Manager Amy Tate has provided hands-on guidance and helped bridge the knowledge gap. “I’ll help by configuring a statement template for them, give it a smoke test, then pass it back,” Amy explains. “After that, the client can check that it produces the right outcomes.”

Testing remains the most significant effort, but the Docmosis Cloud Console has made this process much more efficient. “One document can have conditions for dozens of scenarios.” Tim explains. “That’s the time-consuming part. This is where the Docmosis Cloud Console has been revolutionary.” Clients can generate data from Sovereign, paste it into the Console and test different scenarios quickly. It allows them to refine templates to “99% right” before any full end-to-end checks from Sovereign.

The initial go-live with the first client took place in July 2024, with additional clients beginning migrations in 2025. As clients complete the template conversions, Finzsoft will be able to retire the old publishing system and move fully to Docmosis.

The Result

A few months after the first client went live, Tim, said, “We’re very happy with how Docmosis performed. It was our first really high-volume production month and we had zero issues.”

Other clients who have now migrated their high-volume templates, such as end-of-month statements, are seeing clear performance improvements. One client’s statement run previously took two days, even with six publishing servers in use. “Now,” Tim explains, “the entire run only takes as long as the data extraction, often just a few hours.”

These early results help build momentum for the rest of the migration. “We’ve got one large client that’s very conservative,” Tim says. “They didn’t want to be first, but now with others up and running smoothly, it’ll be easier to get them going, starting with the high volume statements to build their confidence.”

Tim sums it up: “Moving to Docmosis has been a real success. Not only is it faster, it’s more user‑friendly. Clients will find it much easier to maintain their templates and manage ongoing regulatory changes to their documents.”

Future Outlook

As CEO, Helen sees the move to Docmosis a key strategic step. “By embedding Docmosis through API-driven connectivity within our Sovereign banking platform, we’ve enhanced our ability to deliver innovative, reliable solutions for our clients. This digital partnership enhances our document generation capabilities and reinforces our commitment to driving progress and efficiency for financial institutions across Australia and New Zealand.”

Tim adds, “By integrating Docmosis as a best-of-breed document generation system, we have freed ourselves to focus on what truly matters, advancing our core banking solutions and delivering greater value to our customers.”

With a modern, SOC‑compliant, reliable cloud service underpinning their document generation, Finzsoft is better positioned to progress its growth plans within the AU/NZ financial‑services market.